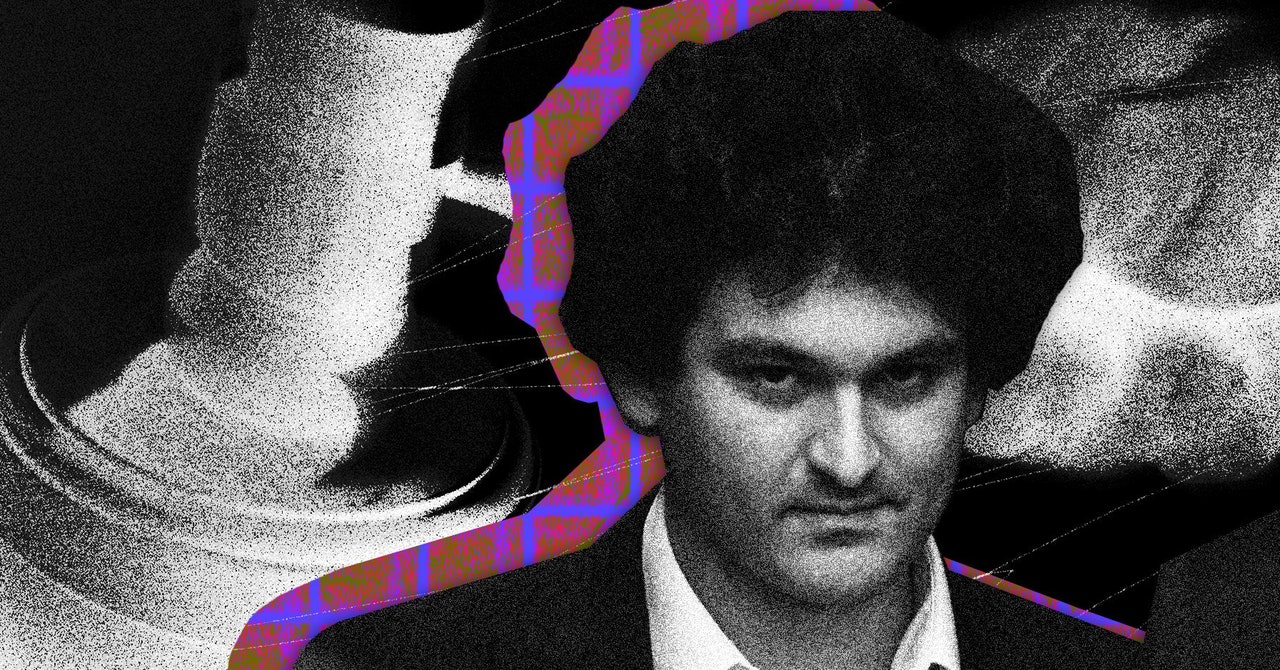

Sam Bankman-Fried, founder of FTX, faces charges of wire fraud and conspiracy, with potential sentence sentence to life in prison

Sam Bankman-Fried, the founder of failed cryptocurrency exchange FTX, is on trial for seven counts of wire fraud and conspiracy. FTX was a fraud “from the start,” the Securities and Exchange Commission alleges — with a “multi-billion-dollar deficiency caused by his own misappropriation of customer funds.”

After an article was published about the financial health of Alameda, his businesses began to fall apart. That prompted spooked customers at FTX to withdraw their funds, in what was effectively a crypto run on the bank.

Bankman- Fried is likely to file an appeal. He is facing the possibility of spending the rest of his life in prison and is in a federal jail in Brooklyn.

During a trial that lasted more than four weeks, prosecutors sought to prove that Bankman-Fried had been a criminal mastermind who orchestrated one of the largest financial frauds in history.

The FTX customer money was used by the former billionaire to buy expensive real estate for friends and family and to make political donations.

“This was a pyramid of deceit built by the defendant on a foundation of lies and false promises, all to get money,” Asst. U.S. Attorney Nicholas Roos told the court in his closing argument. “And eventually it collapsed, leaving countless victims in its wake.”

A 31 year old graduate of the M.I.T. who was living a $35 million apartment with many of his co-workers, was convicted of conspiracy to commit wire fraud in a case that was seen as a huge reversal of fortune.

As FTX grew, Bankman-Fried became a celebrity in his own right at a time when the popularity of cryptocurrencies surged. There was a wave of investments from amateur traders and established Wall Street firms alike, and Bankman-Fried capitalized on the craze.

Instantly recognizable by his disheveled hair and his typical attire of a T-shirt and shorts, he was feted at conventions, and hung out with celebrities like former quarterback Tom Brady.

Sam Bankman-Fried is found guilty of all charges and can face decades in prison: a case study with Danielle Sassoon

Then, one by one, Bankman-Fried’s former executives started to turn against him, including Caroline Ellison, who headed Alameda at one point, and was also his on-again, off-again girlfriend.

She and other colleagues, including Gary Wang – who co-founded Alameda Research and FTX with Bankman-Fried — pleaded guilty to separate charges, and agreed to cooperate with federal prosecutors.

They told the court Bankman-Fried directed them to commit crimes, and their comments were especially compelling because the cooperating witnesses weren’t just Bankman-Fried’s colleagues, they were also some of his closest friends.

It was perhaps the most dramatic moment in the trial when Bankman-Fried testified in his own defense.

Danielle Sassoon worked for Antonin Scalia, who clerked for the late Supreme Court Justice.

Sassoon used Bankman-Fried’s comments to show that there was a stark difference between what Bankman-Fried said in public, and how he acted behind the scenes.

For example, when FTX was teetering on the brink, Bankman-Fried told his hundreds of thousands of followers on X, formerly known as Twitter, it was in sound shape, even as prosecutors claimed he knew that couldn’t have been farther from the truth.

The prosecution painted a picture that was not in accord with Bankman-Fried’s claim that he was a math whiz who became a movie villain.

The defense also tried to argue Bankman-Fried was an inexperienced executive who was unable to keep tabs on what was happening at two multibillion dollar companies or to properly supervise executives at FTX and Alameda Research.

Source: Sam Bankman-Fried is found guilty of all charges and could face decades in prison

Detecting a criminal misuse of crypto-currencies in the US Department of Justice and the Bankman- Fried criterion

Cohen said people misunderstand things in the real world. “They are somewhat hesitant.” They don’t plan for the unexpected. They make good and bad business decisions but later on they wish they’d fixed them.

As a boy coming of age in the most rarefied quarters of the achievement class, he grew up in a family that viewed the celebration of birthdays and holidays as an inefficiency easily forgone. Michael Lewis writes in his book “Going Infinite” that from his childhood, an adult who worked 22 hours a day submitted the chance of any interaction with another person to a cost-benefit calculation that often left him canceling meetings and other obligations at the last minute.

What would a jury of his peers possibly look like? Or, in the specific absence of that, what would 12 ordinary people see when they were seated on the other side of the witness stand from him? The prosecution thought they would see a grown man, whose self-destructive tendencies made him a criminal, instead of a young man with his enthusiasm for making billions of dollars. In the end, the jury saw an adult.

The US Department of Justice will consider theBankman- Fried’s conviction as its first high-profile crypto scalp. For more than a decade, there has been a use of cryptocurrencies to obscure payment for illegal products, enable cyberattacks and launder the proceeds of criminal activity. In 2021, the DoJ announced the formation of a specialist crypto enforcement team, to “tackle complex investigations and prosecutions of criminal misuses of cryptocurrency,” it said. The agency has secured landmark convictions in the past.